Blog

We are excited to release a low-cost, Single Touch Payroll (STP) solution for very small businesses: Wages 1-4.

We released this solution in response to an ATO initiative aimed to assist businesses with very few employees, who do not currently use payroll software, to begin Single Touch Pay...

You’ve got your business, employees and cash flow all set up. You then start thinking where your next sale is coming from and how to get more customers.

This is a question that many small business owners have asked at some point on their journey. Sales are essential to business and without sales, you...

The final findings and recommendations by Commissioner Hayne were released to the public on Monday 4th February. We have sifted through the 76 recommendations and drawn out those which will impact SMEs and those in the agricultural industry specifically.

SMEs

The definition of small business

This ...

As a freelancer – or being self-employed – one of your biggest problems is probably getting people to pay you, and pay you on time as well. You can be the best at your job and deliver amazing projects but invoices are still a massive issue in a lot of industries.

There’s an alarming statistic going a...

Single Touch Payroll (STP) is almost here and Cashflow Manager is working with the ATO to make sure that you are ready to go when it becomes mandatory for businesses with 20 or more employees on 1 July 2018.

Cashflow Manager Gold and Wages Manager is Single Touch Payroll compliant and will delivers a...

Since the introduction of SuperStream in Australia, the Small Business Superannuation Clearing House (SBSCH) has provided small businesses and sole traders with an easy option to make SuperStream compliant contributions.

On 26 February 2018, the SBSCH will join existing Australian Tax Office (ATO) se...

Cash is vital for small businesses – to pay their staff, to purchase stock, meet their tax obligations and explore new opportunities. A lot of our small business clients experience cash flow troubles due to their accounts being settled late.

Avoid feeling awkward about chasing up late payments ...

As the new year begins our thoughts usually turn to new beginnings and making resolutions. It’s a way of promising ourselves to improve in year ahead. That applies as much to your business as it does to your personal life.

If you are starting the year with the intention of repeating what you did the ...

While Santa’s double checking his naughty and nice lists, make sure you check out our list of 7 tips to make sure your small business is all set for a jolly holly Christmas.

Get into the festive spirit

The end of a year is also a great time to celebrate and acknowledge the hard work and achievements o...

A business budget is a vital tool for success in starting and operating your business. It can help you plan the items and expenses necessary if you are a start-up, assist you with getting a business loan, show you how much you can spend each month, and help know how much money you need to make to me...

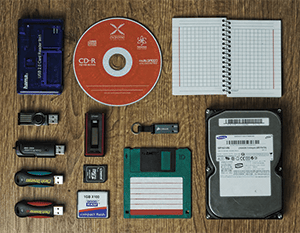

Everyone knows the importance of backing up their small business data, yet here at Cashflow Manager we still get many calls about lost financial information. Don’t wait until disaster strikes to find out that your backup system isn’t working. Here are three common backup mistakes to look out for.

Ski...

The Australian Tax Office (ATO) have simplified GST reporting for small business by reducing the amount of GST information required in Business Activity Statements (BAS).

From the 1st of July 2017, small businesses will be automatically transferred to Simpler BAS. There are no changes to the rep...

IMPORTANT: Cashflow Manager 11 has been replaced by a newer software version – for details on the latest version of Cashflow Manager Products visit our Download Centre and Cashflow 12 Blog.

We are delighted to let you know that you can now download Version 11 of Cashflow Manager, Cashf...

In our recent blog “ATO announces simpler BAS reporting for Small Business†we discussed how the ATO” introduction on 1 July 2017, of simplified BAS would make it considerably easier for small business to manage their returns.

Basically, the reporting requirement for BAS has been simplified so that...