The Australian Tax Office (ATO) have simplified GST reporting for small business by reducing the amount of GST information required in Business Activity Statements (BAS).

From the 1st of July 2017, small businesses will be automatically transferred to Simpler BAS. There are no changes to the reporting frequency or how other taxes are reported on your BAS.

This means you only need to report the following GST information:

- G1 Total Sales

- 1A GST on Sales

- 1B GST on Purchases

How does this work in Cashflow Manager?

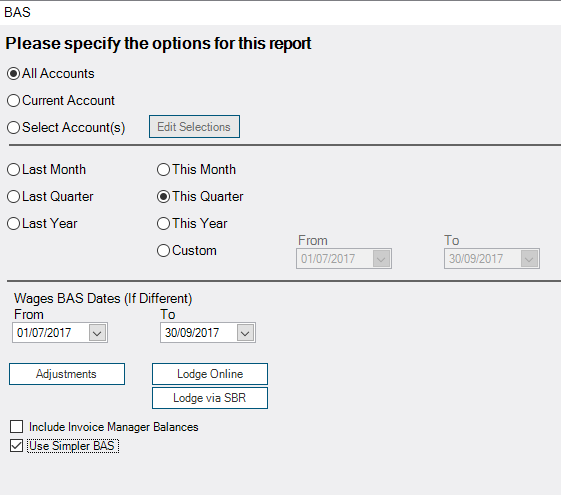

The BAS report in Cashflow Manager now includes a ‘Simpler BAS’ check-box. Simply tick this box to show a reduced amount of GST information.

Lodging your BAS online

The activity statement option in the ATO Business Portal menu is your starting point for lodging or revising most types of activity statements online. When you lodge online you will receive a receipt to confirm that your activity statement has been lodged and you can also view and print statements you have lodged previously.

From 1 July 2017, you will no longer need to re-enter your AUSkey or myGov credentials to declare that the information provided in your activity statement is true and correct – you just need to tick a declaration checkbox.

Download a free BAS guide for small businesses

Our quick guide to BAS includes much-needed information on:

- What exactly is a Business Activity Statement (BAS)?

- How to know if you need to lodge a BAS

- Understanding due dates

- Tips to make BAS lodgement easier

- Help submitting a BAS online